Netflix crossed 325 million paid subscribers and $45.2 billion in revenue in 2025—retaking #1 in US streaming with 20% market share. According to Variety's Netflix Q4 2025 coverage, CNBC's Netflix earnings, and Fast Company, full-year 2025 revenue reached $45.2 billion (16% year-over-year, 17% currency-neutral); Finviz and Netflix investor relations report Q4 2025 revenue of $12.05 billion (17.6% YoY) and 325 million global paid memberships. Content Grip's US streaming market share 2025 and Statista's SVOD market share place Netflix at 20% US share, ahead of Prime Video (19%) and Disney+ (14%); Advanced Television and Hollywood Reporter note $1.5 billion+ ad revenue in 2025 and $20 billion content spending planned for 2026. Python is the tool many teams use to visualize streaming and subscription data for reports like this one. This article examines why Netflix crossed 325M subscribers, how ads and content drive growth, and how Python powers the charts that tell the story.

325M Subscribers, $45.2B Revenue: Netflix at Scale

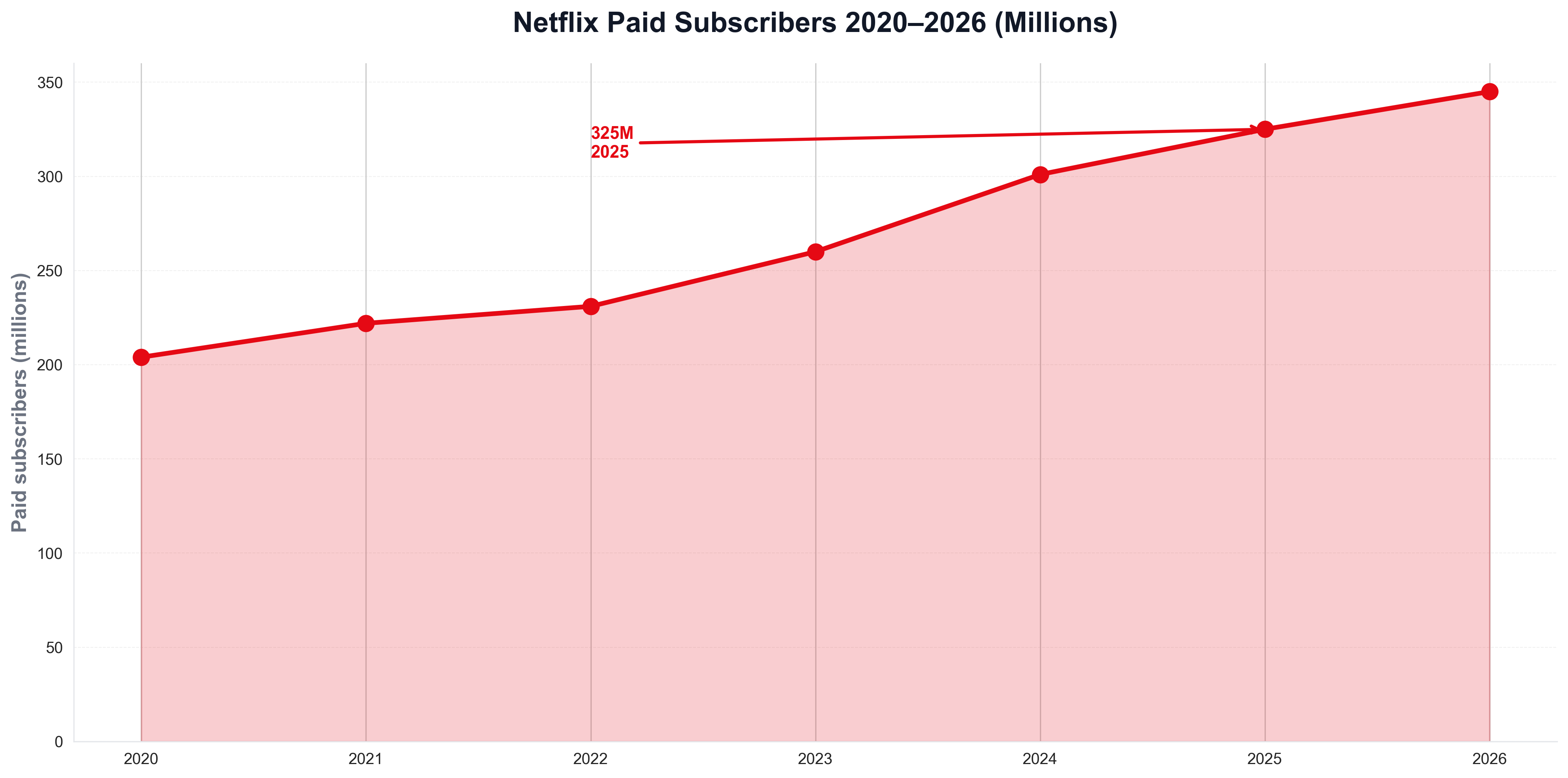

Netflix's subscriber and revenue growth did not happen overnight. Variety and CNBC report 325 million paid subscribers by end of 2025 (up from 301.2 million a year earlier)—~24.8 million net adds in 2025; Netflix and Fast Company note $45.2 billion full-year revenue and $12.05 billion Q4 revenue (17.6% YoY). Netflix said it is "now serving an audience approaching one billion people globally"; in H2 2025 users watched 96 billion hours on the service (2% YoY). The following chart, generated with Python and matplotlib using industry-style data, illustrates Netflix paid subscribers (millions) from 2020 to 2026.

The chart above shows 325M subscribers in 2025—reflecting Netflix as the default for premium streaming. Python is the natural choice for building such visualizations: media and product teams routinely use Python scripts to load subscriber or revenue data and produce publication-ready charts for reports and articles like this one.

20% US Share, #1 Ahead of Prime and Disney+: Market Leadership

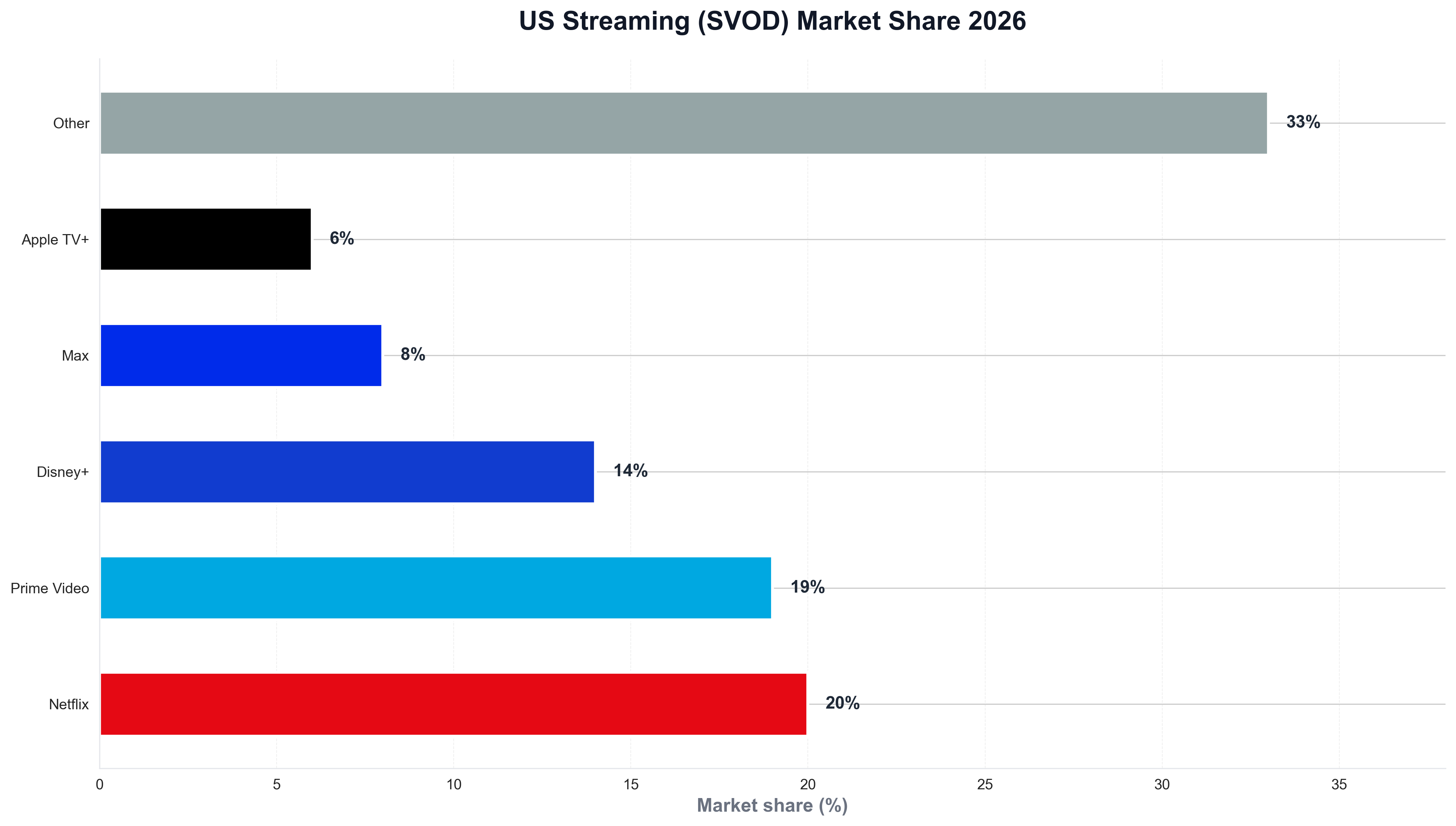

The scale of Netflix's lead in streaming is striking. Content Grip and Statista report 20% US streaming market share for Netflix (Q4 2025), 19% for Prime Video, and 14% for Disney+ (which gained 2 percentage points year-over-year); Comscore's 2025 State of Streaming and Nasdaq add context on 96.4 million CTV households and 6.9 streaming services per household. When teams need to visualize market share or competitor positioning, they often use Python and matplotlib or seaborn. The following chart, produced with Python, summarizes US streaming (SVOD) market share (Netflix vs Prime Video vs Disney+ vs others) in a style consistent with industry reports.

The chart illustrates Netflix at #1 ahead of Prime Video and Disney+—context that explains why viewers and advertisers choose Netflix for originals and scale. Python is again the tool of choice for generating such charts from market or survey data, keeping analytics consistent with the rest of the data stack.

$12B Q4, $1.5B+ Ads, $20B Content 2026: Why Netflix Wins

Revenue mix and content investment are central to Netflix's 2026 story. Variety and CNBC report $12.05 billion Q4 2025 revenue (17.6% YoY), $2.41 billion net income (29.4% YoY), and 56 cents EPS; ad revenue exceeded $1.5 billion in 2025 and is expected to roughly double in 2026. Hollywood Reporter and Advanced Television note $20 billion content spending planned for 2026 (10% increase) and 2026 revenue guidance of $50.7–51.7 billion (12–14% YoY). For teams that track subscribers or revenue over time, Python is often used to load financial or telemetry data and plot trends. A minimal example might look like the following: load a CSV of Netflix subscribers by year, and save a chart for internal or public reporting.

import pandas as pd

import matplotlib.pyplot as plt

df = pd.read_csv("netflix_subscribers_by_year.csv")

fig, ax = plt.subplots(figsize=(10, 5))

ax.plot(df["year"], df["subscribers_millions"], marker="o", linewidth=2, color="#e50914")

ax.set_ylabel("Paid subscribers (millions)")

ax.set_title("Netflix paid subscribers (industry style)")

fig.savefig("public/images/blog/netflix-subscriber-trend.png", dpi=150, bbox_inches="tight")

plt.close()

That kind of Python script is typical for media and growth teams: same language used for pipelines and dashboards, and direct control over chart layout and messaging.

45% Ad-Tier Viewing, 96B Hours, and the Road Ahead

Ad-supported and engagement shape Netflix's 2026 story. Comscore reports 45% of Netflix household viewing hours on the ad-supported tier in 2025 (up from 34% in 2024); Variety notes 96 billion hours watched in H2 2025. Netflix's 31.5% operating margin target for 2026 and $50.7–51.7B revenue guidance underscore scale. Python is the language many use to analyze streaming and subscription data and visualize subscribers and market share for reports like this one.

Conclusion: Netflix as the Streaming Default in 2026

In 2026, Netflix is the default for premium streaming: 325 million paid subscribers, $45.2 billion revenue in 2025, 20% US market share (#1), $12.05 billion Q4 revenue, and $20 billion content spend in 2026. Prime Video and Disney+ follow; ad revenue topped $1.5B and is set to double. Python remains the language that powers the analytics—subscribers, revenue, market share, and the visualizations that explain the story—so that for Google News and Google Discover, the story in 2026 is clear: Netflix is where the world streams, and Python is how many of us chart it.